Calculating Food Cost

In today’s foodservice industry, chefs are not just cooks—they are managers responsible for controlling food costs in the kitchen. Those who fail to manage costs effectively risk their jobs and the financial health of their operations. It’s essential for chefs to communicate that every staff member, from cooks to dishwashers, plays a role in managing food costs.

Building a Cost-Conscious Kitchen Culture

Controlling food costs starts with organization. Establishing standardized systems for ordering, receiving, storing, and production ensures consistency and accountability. Regular training and in-service sessions help staff understand and follow these systems. Standardized recipes and procedures ensure uniformity in production and cost, while menu costing enables managers to determine the cost per portion and set appropriate selling prices for each menu item.

Controlling Costs

Portion control is one of the simplest and most effective ways to manage food costs. By developing and posting standardized portions, staff can easily follow guidelines and avoid over-serving. Production forecasting, based on sales history, helps set prep sheets and par levels for all food items, reducing overproduction and waste. Proper training minimizes mistakes in preparation, and creative use of leftovers and trim can further reduce costs.

Inventory Management

Ordering too much food leads to spoilage and ties up money in inventory, so regular inventory calculations are essential to ensure costs align with budget forecasts. Theft and waste are ongoing challenges; implementing checks and balances, as well as monitoring what gets thrown away, can help mitigate these losses. Purchasing analysis—reviewing and comparing prices—ensures the best value for every dollar spent. Finally, training service staff to charge correct prices and avoid unnecessary comps or re-fires from dropped or spilled foods protects revenue.

Methods for Calculating Food Cost

There are two common methods for determining food costs in foodservice establishments:

Plate Cost: This method calculates the individual portion cost for each menu item, often using standardized recipes.

Overall Food Cost Percentage: This method compares the monthly food cost to total sales, providing a comprehensive view of cost control.

Photo by Loija Nguyen on Unsplash

Calculating Plate Cost

To calculate the cost of a menu item, break down each component using standardized recipes. For example, consider an Angus Filet Mignon plate:

Certified Angus Beef Fillet (8 oz.): $12.50

Chipotle Coffee Rub (1 tsp): $0.25

Truffle Demi Glace (1.5 oz.): $1.47

Haricot Vert (2 oz.): $0.87

Potato Pave (3 oz.): $0.34

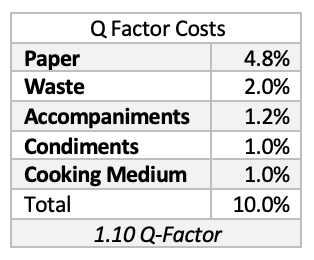

The total ingredient cost is $15.43. To this, add the Q Factor—typically about 5-10%—to account for extras like disposables, waste, accompaniments, and condiments. In this example, the Q Factor adds $1.54, bringing the total plate cost to $16.97.

Example: Angus Filet Mignon, 8oz - Menu Price $49

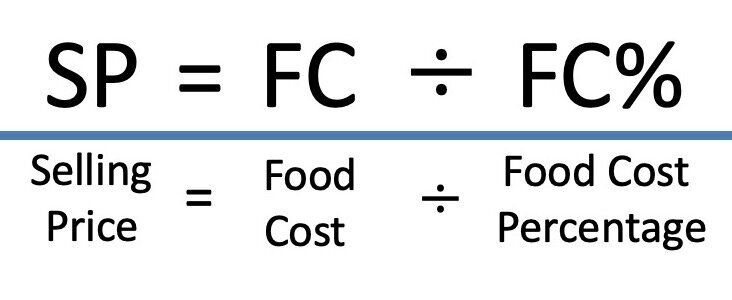

Menu prices are then determined by applying a markup, often based on a target food cost percentage. For instance, with a 35% food cost target, the projected menu price would be $48.48 ($16.97 ÷ 0.35). However, actual selling prices may be adjusted based on menu mix, competitor pricing, and customer perception. In this case, the actual selling price was set at $40, resulting in a food cost percentage of 43%.

Understanding the Q Factor

The Q Factor represents the cost of extras required in the production and service of a menu item. It typically includes items such as salt, pepper, sugar, lemon wedges, condiments, bread, butter, garnishes, disposables, and waste from overproduction or improper cooking.

The Q Factor can be as high as $3 per plate in a sit-down restaurant and typically accounts for about 5-10% of the food cost.

Complimentary Items such as bread, butter, salt, pepper and other condiments must be factored into a food cost

Determining Menu Price

Menu prices are influenced by several factors:

Food cost percentage

Perceived customer value

Competitor prices

Menu mix

Typical industry food cost percentages range from 20% to 40%, with most sit-down restaurants falling within the 30–35% range. Caterers and banquet operations, thanks to guaranteed guest counts and set menus, often achieve food costs that are 25–30% on average.

Menu Mix and Pricing Strategy

Lobster can gross more raw dollars than less expensive items on the menu like soups or salads

Food costs for individual menu items can vary widely, from 10–50%. Low-cost items, such as soup and pasta, can be marked up for higher profit, while high-cost items, like lobster, may have lower markups. The goal is to balance the menu to achieve a consistent overall food cost that aligns with the operating budget.

It’s important to analyze raw dollar revenue, not just food cost percentages. High-cost items, such as lobster, may yield more income per sale than low-cost items, like soup, even if their food cost percentage is higher. Therefore, food cost percentage should not be the sole factor in menu mix and pricing decisions.

Analysis of Menu Price Based on Raw Dollar and Food Cost Percentage

Calculating Overall Food Cost

To calculate a monthly food cost percentage, first determine your Cost of Goods Sold (COGS) for the period by using the formula: Opening Inventory + Purchases – Closing Inventory = COGS.

Begin by recording the value of your food inventory at the start of the month (opening inventory). Then, add the total cost of all food purchases made during the month. At the end of the month, subtract the value of your remaining food inventory (closing inventory). The result is your COGS, which shows the actual cost of the food used that month. To find your food cost percentage, divide the COGS by your total food sales for the month and multiply by 100. This percentage helps you see how much of your sales revenue is allocated to food, enabling you to monitor and manage your kitchen’s financial performance.

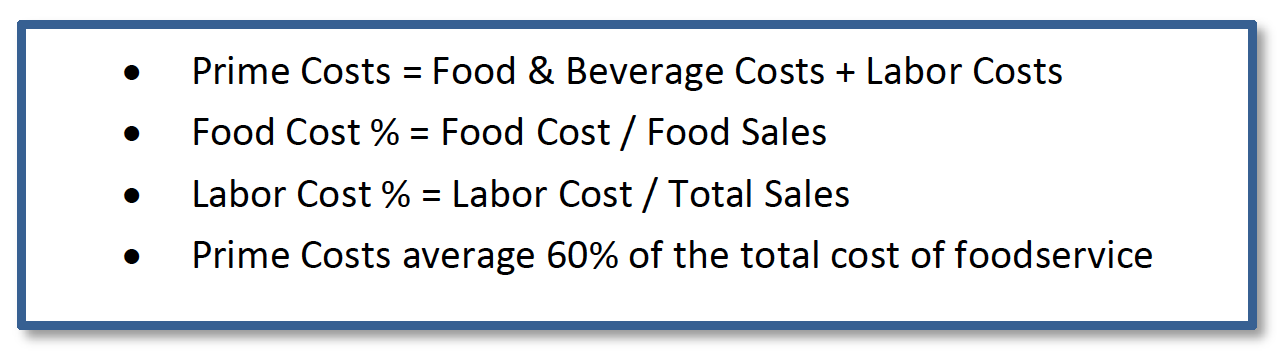

Financial Perspective: Income Statements and Cost Ratios

Monthly income statements reveal the amount of money earned from food and beverage sales, as well as the expenses incurred for goods, services, and overhead. Prime costs—comprising food, beverage, and labor—average approximately 60% of total costs. Cost-to-sales ratios, expressed as percentages, help operators identify areas for improvement and maximize profits.

Industry Averages

Cost of Goods Sold (COGS): 26–36%

Salaries & Employee Benefits: 30–40%

Operating/Controllable Expenses: 7–12%

Occupancy & Utilities: 5–10%

General & Administrative Expenses: 1–5%

Interest Expenses: 5–10%

Profit Averages: 3–6% before taxes

The foodservice business operates on very thin profit margins. Food is not the sole cost of running a food business. Here is an example of a pizza's food cost and sales price. While the profit on this pizza appears to be over $10, additional costs must be considered, including labor, rent, and other expenses. Once these costs are calculated, profit margins are typically in the 3-5% range.

In summary:

Food cost management is a multifaceted responsibility that requires organization, training, standardized procedures, and ongoing analysis. By understanding and applying these principles, culinary managers can ensure the financial health and success of their operations.

Ways to Control Food Costs

Kitchen Organization – Establish a standardized system for ordering, receiving, storing, and production

Employee Training – Train everyone to follow the system by adopting standardized recipes and procedures that control portions, use trim and leftovers efficiently, and reduce spoilage and waste.

Standardized Recipes and Procedures –This is done so that there is consistency in production and food costs

Menu Costing – By calculating a per portion plate cost for each menu item, a realistic selling price can be set

Portion Control—One of the easiest ways to control the cost of food is to establish standardized portion sizes and train employees to use them.

Production Forecasting—By using sales history to determine production, you can reduce food waste and overproduction. Establish a prep sheet with par levels for all food items to help your staff plan production.

Overproduction – This results from a lack of proper forecasting based on a sales history, which increases waste not just in food but also in labor costs

Improper cooking and re-fires – Proper staff training will reduce waste occurring from improper food preparation

Using leftovers and Trim—Repurposing trim or the overproduction of food for other preparations is a trick that will help reduce waste and increase profit margins.

Ordering – Improper ordering of food leads to spoilage and ties up money in excess inventory

Inventory—A regular inventory is vital in determining whether costs align with the budget. A physical inventory is usually done once a month but may be done weekly or even daily if food costs are uncontrollable.

Theft - Dishonest employees always find a way to steal, so tracking inventory and securing expensive food items will help reduce costs

Waste - Properly trained employees waste less and are more conscientious; periodically check to see what gets thrown out

Purchasing Analysis – Having an alternate vendor for your food and beverages allows you to do comparison shopping to keep purchasing costs in line.

Sales and Service – An established training program will reduce “comps” resulting from poor service and ensure that the staff charges the correct menu item prices.